INTRODUCTION

DDB function comes under the FINANCIAL FUNCTIONS category in Excel.

DDB returns the depreciation of an asset for a specified period using the double-declining balance method.

Other methods can also be used by changing the FACTOR(will be discussed later in this article)

PURPOSE OF DDB IN EXCEL

DB returns the depreciation of an asset for a specified period using the DOUBLE-declining balance method.

PREREQUISITES TO LEARN DDB

THERE ARE A FEW PREREQUISITES WHICH WILL ENABLE YOU TO UNDERSTAND THIS FUNCTION IN A BETTER WAY.

- Basic understanding of how to use a formula or function.

- Basic understanding of rows and columns in Excel.

- Some information about the financial terms is an advantage for the use of such formulas.

- Of course, Excel software.

Helpful links for the prerequisites mentioned aboveWhat Excel does? How to use formula in Excel?

SYNTAX: DDB FUNCTION IN EXCEL

The Syntax for the function is

=DDB(COST, SALVAGE VALUE, LIFE , PERIOD,FACTOR)

COST Initial cost of the asset.

SALVAGE VALUE Remaining value of asset at the end of its life.

LIFE Useful life of the asset.

PERIOD Period for which the depreciation is to be calculated.(e.g. after 2 years or 4 years or so. Unit must be same as life)

FACTOR Shows the rate at which depreciation takes place. If it is 2 , it is known as DOUBLE DECLINING BALANCE method. It can be 3,4 … etc.

FORMULA BEHIND THE FUNCTION

The following formula is being used at the back end to calculate the result for you.

Double Declining balance method of depreciation is an accelerated depreciation method in which the depreciation expense declines with age of the fixed asset. In this method, the depreciation takes place at TWICE THE RATE of the straight line depreciation. This method is especially used to explain the reason that the service provided by the asset degrades with time. It performs well when new and not so well when getting old.

DDB uses the following formula to calculate depreciation for a period:

Min( (cost - total depreciation from prior periods) * (factor/life), (cost - salvage - total depreciation from prior periods) )

EXAMPLE:DDB IN EXCEL

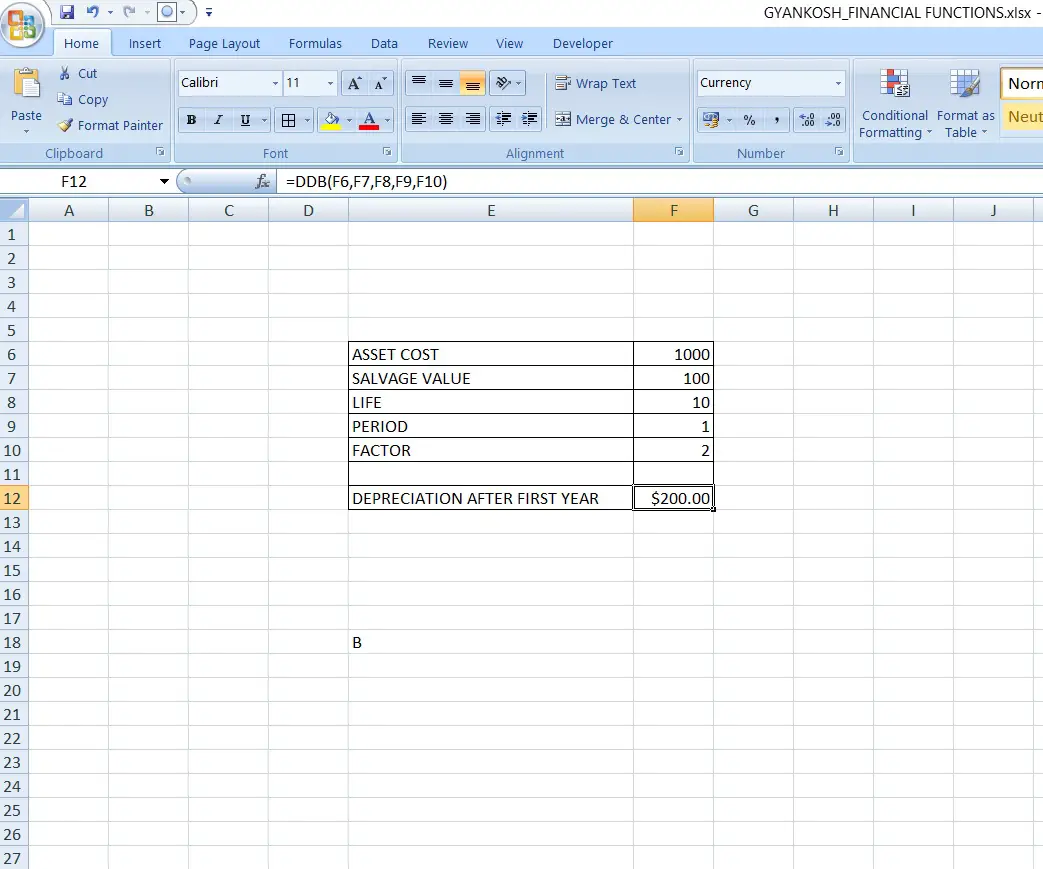

DATA SAMPLE

| ASSET COST | 1000 |

| SALVAGE VALUE | 100 |

| LIFE | 10 |

| PERIOD | 1 |

| FACTOR | 2 |

STEPS TO USE DDB

The data is put in the cells from F6 TO F10.For the resultwe put the formula in F12 as

=DDB(F6,F7,F8,F9,F10)

The result comes out to be $200 which is the depreciated amount for the first year.