INTRODUCTION

COUPPCD function comes under the FINANCIAL FUNCTIONS category in Excel.

COUPPCD returns a number that represents the previous coupon date before the settlement date.

PURPOSE OF COUPPCD IN EXCEL

COUPPXS returns the date of previous coupon payment before the settlement date.

PREREQUISITES TO LEARN COUPPCD

THERE ARE A FEW PREREQUISITES WHICH WILL ENABLE YOU TO UNDERSTAND THIS FUNCTION IN A BETTER WAY.

- Basic understanding of how to use a formula or function.

- Basic understanding of rows and columns in Excel.

- Some information about the financial terms is an advantage for the use of such formulas.

- Of course, Excel software.

Helpful links for the prerequisites mentioned aboveWhat Excel does? How to use formula in Excel?

SYNTAX: COUPPCD

The Syntax for the function is

=COUPPCD(SETTLEMENT DATE, MATURITY DATE,NUMBER OF COUPON PAYMENTS, BASIS)

SETTLEMENT DATE is the security’s settlement date. The security settlement date is the date after the issue date when the security is traded to the buyer.

MATURITY DATE is the security’s maturity date. The maturity date is the date when the security expires.

NUMBER OF COUPON PAYMENT(FREQUENCY) is the number of coupon payments per year. For annual payments, frequency = 1; for semiannual, frequency = 2; for quarterly, frequency = 4.

BASIS is the type of day count basis to use.

| Basis | Day count basis |

|---|---|

| 0 or omitted | US (NASD) 30/360 |

| 1 | Actual/actual |

| 2 | Actual/360 |

| 3 | Actual/365 |

| 4 | European 30/360 |

THE DATES SHOULD BE PUT USING THE DATE FUNCTION

=DATE(YYYY,MM,DD) OTHERWISE IT’LL RETURN AN ERROR.

FREQUENCY: It can be only 1,2 or 4.

EXAMPLE:COUPPCD IN EXCEL

DATA SAMPLE

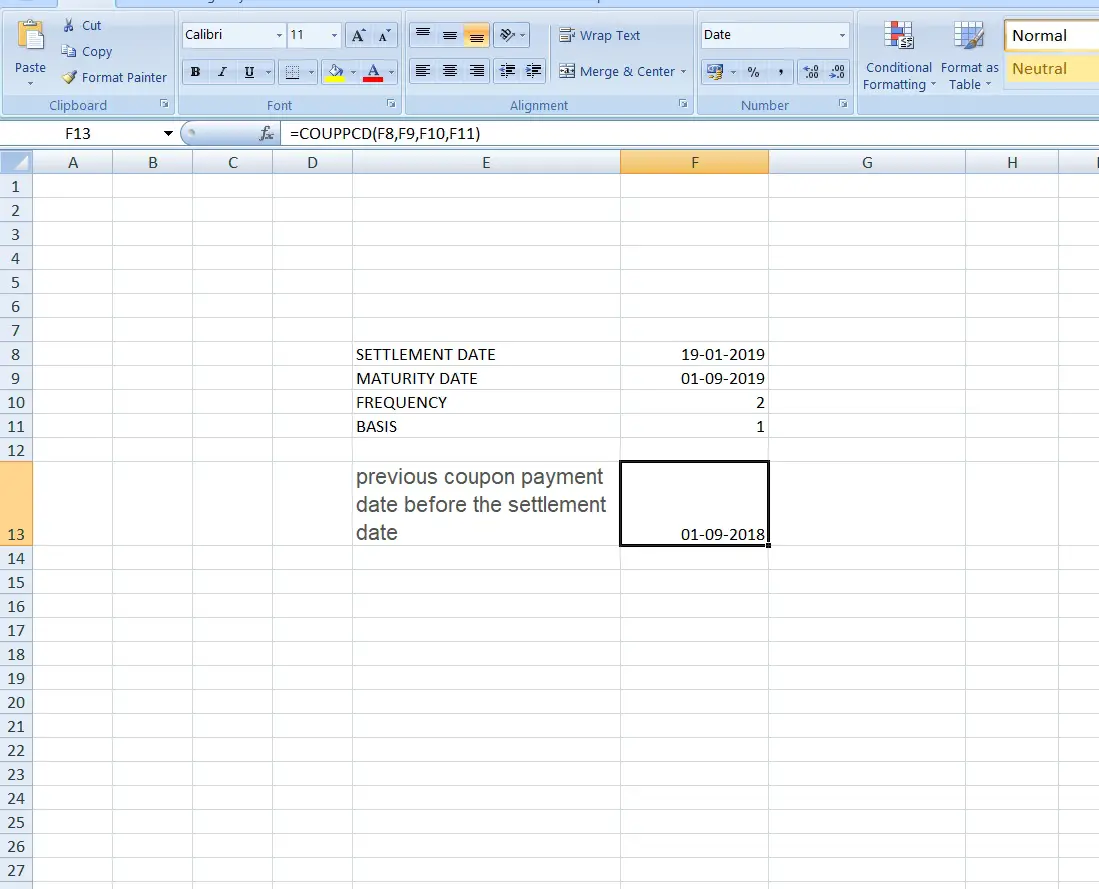

The settlement date for the example is 19.01.2019

Maturity date is 1.09.2019

Freq of payout is 2

and basis is 1.

STEPS TO USE COUPPCD

The data is put in the cells from F8 TO F11.For the resultwe put the formula in F13 as

=COUPPCD(F8,F9,F10,F11)

The result comes out to be 1.09.2018 which was the payout date before the settlement date.

CONFUSION CLARIFICATIONS

NUMBER OF DAYS CALCULATION

We should always be having knowledge about the working of a function. Otherwise we may be stuck in a situation where we never know whether the answer is correct or not.

These formulas are doing nothing but playing with the dates.

MS Excel is converting the date to a number first. Number is the number of days after JAN 1 1900.

After converting to number it subtracts to find out the number of days between any two dates.

The same procedure is being followed up in these financial formulas.

These can be done with the simple calculations also but when we have a ready function, we can always take help.

COUPPCD simply tells the previous payout date before settlement date.